by Cezary Podkul ProPublica, June 7, 2017, 3:21 p.m.

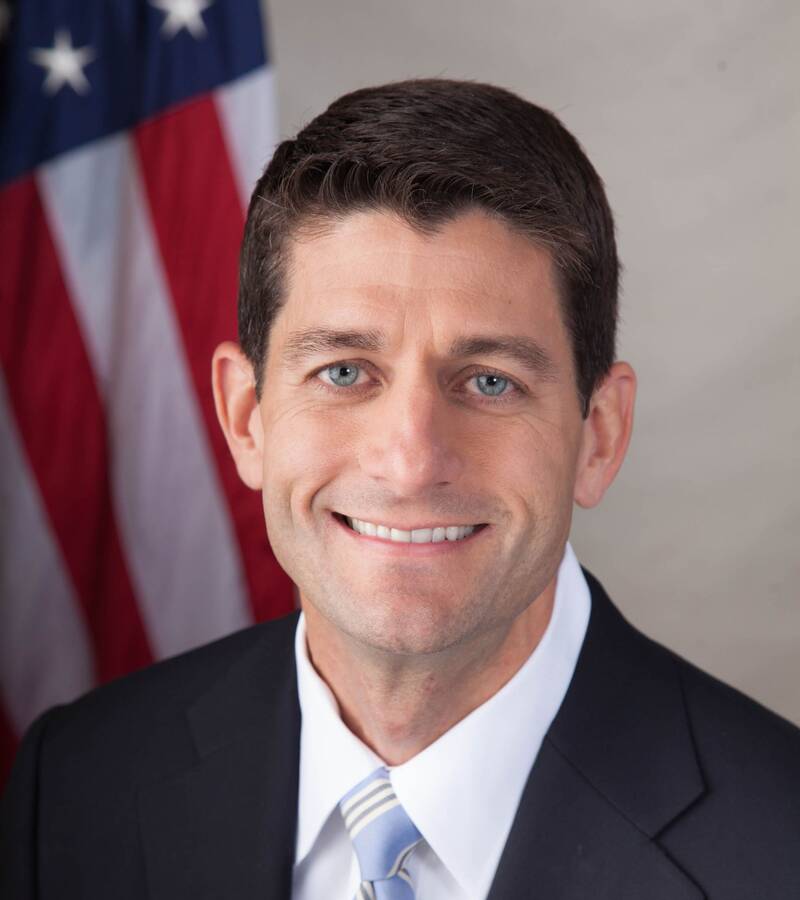

Does the estate tax really hurt small businesses? House Speaker Paul Ryan thinks so.

He revived this longstanding debate in a May 17 column in the Kenosha News, in which he defended the Republican plan to abolish the levy on inherited wealth. Ryan wrote that the "death tax" can "result in double, and potentially even triple, taxation on small businesses and family farms, both of which are prevalent in Wisconsin."

President Trump made a similar claim in his budget proposal a few days later, calling for repeal of the estate tax on the grounds that it "penalizes farmers and small business owners who want to pass their family enterprises on to their children."

Such advocacy for small business owners, a key GOP base, is politically shrewd. But whether it fits the facts is less clear. Democrats have countered that the estate tax actually penalizes the ultra-rich — another traditional Republican constituency — far more than farmers or small business owners.

Ryan's op-ed provided a petri dish in which we could test the Republican position. What we found is that the odds of a small business owner in Wisconsin being subject to the estate tax are — under very generous assumptions — about 1 in 64. By comparison, that's only slightly higher than the risk of dying from unintentional poisoning, according to data from the National Safety Council. In raw numbers, about as many people drown in Wisconsin in a year as die leaving taxable estates.

Ryan wrote in his op-ed that small businesses make up nearly 98 percent of all employers in Wisconsin. The vast majority file federal returns as individuals, at an income tax rate up to 44.6 percent, he wrote. Via estate taxes, he contended, heirs pay taxes a second time on the same assets.

The current federal estate tax threshold is about $5.5 million for an individual and $11 million for a married couple. For 2015 — the last year for which statistics are available — the IRS said 61 estates in Wisconsin got hit with the tax. Is that a lot or a little? Here are some numbers for context.

There are approximately 445,000 small businesses in Wisconsin, according to the U.S. Small Business Administration.

It's not clear how many small business owners die in any given year. But assuming that they succumb at the same rate as Wisconsin's population as a whole — 874 deaths per 100,000 people, according to the Centers for Disease Control and Prevention — that would translate into a total universe of just under 3,900 deceased small business owners whose estates might be taxed.

Now assume that all 61 estates that actually paid taxes belonged to small business owners. That's unlikely, because some of the 61 probably accumulated their wealth another way — through stakes or executive positions in major corporations, for example. But even if our assumption were valid, it would mean that only 1.6 percent of small business owners left enough wealth to owe any federal estate tax.

Another way to contextualize the data is to look at the overall number of deaths in Wisconsin. According to the state's Department of Health Services, about 50,000 Wisconsin residents die each year. Since 61 estates were taxed in 2015, only about one-tenth of 1 percent of all deaths in Wisconsin generate an estate tax bill.

That's slightly lower than the U.S. average. Nationally, about 1 in 500 estates are big enough to get hit with the federal estate tax, according to the Congressional Joint Committee on Taxation.

The numbers get even smaller when you look at the impact on the state's farmers. Nationwide, IRS data shows that about 13 percent of taxed estates include any farm assets. Apply that percentage to Wisconsin's 61 taxed estates, and you might expect eight of them to be farms.

There are about 68,700 farm operations in Wisconsin, according to the U.S. Department of Agriculture. If you assume the owners all pay taxes as individuals and die at the same rate as the state's overall population, 1.3 percent would owe estate tax upon death.

Moreover, heirs of the small proportions of farmers or small business owners with taxable estates might not have to sell the property to foot the bill right away. The IRS allows taxpayers to spread estate tax payments into smaller installments due over many years.

We shared our math with Ryan's spokeswoman, who did not respond.

Others who reviewed the calculations said they're simply an indication of whom the estate tax actually targets.

"The purpose of the estate tax is to say, ‘If you have a significant amount of wealth, you should pay some part of it as a tax when you die,'" said Roberton Williams, a senior fellow at the Urban-Brookings Tax Policy Center. "The people that the tax affects are the people who are really well-off and it's a tiny sliver of the population."

ProPublica is a Pulitzer Prize-winning investigative newsroom. Sign up for their newsletter.

Memberships

Steve is a member of LION Publishers , the Wisconsin Newspaper Association, the Menomonie Area Chamber of Commerce, the Online News Association, and the Local Media Consortium, and is active in Health Dunn Right.

He has been a computer guy most of his life but has published a political blog, a discussion website, and now Eye On Dunn County.

Add new comment